Government-backed investment schemes have an important role in personal finance.

For many families, especially first-time investors, these schemes form the foundation of their investment journey.

Their biggest advantage as well as disadvantage is the long lock-in. It is difficult to pre-maturely close or withdraw from these schemes. So, they allow compounding to work quietly in the background.

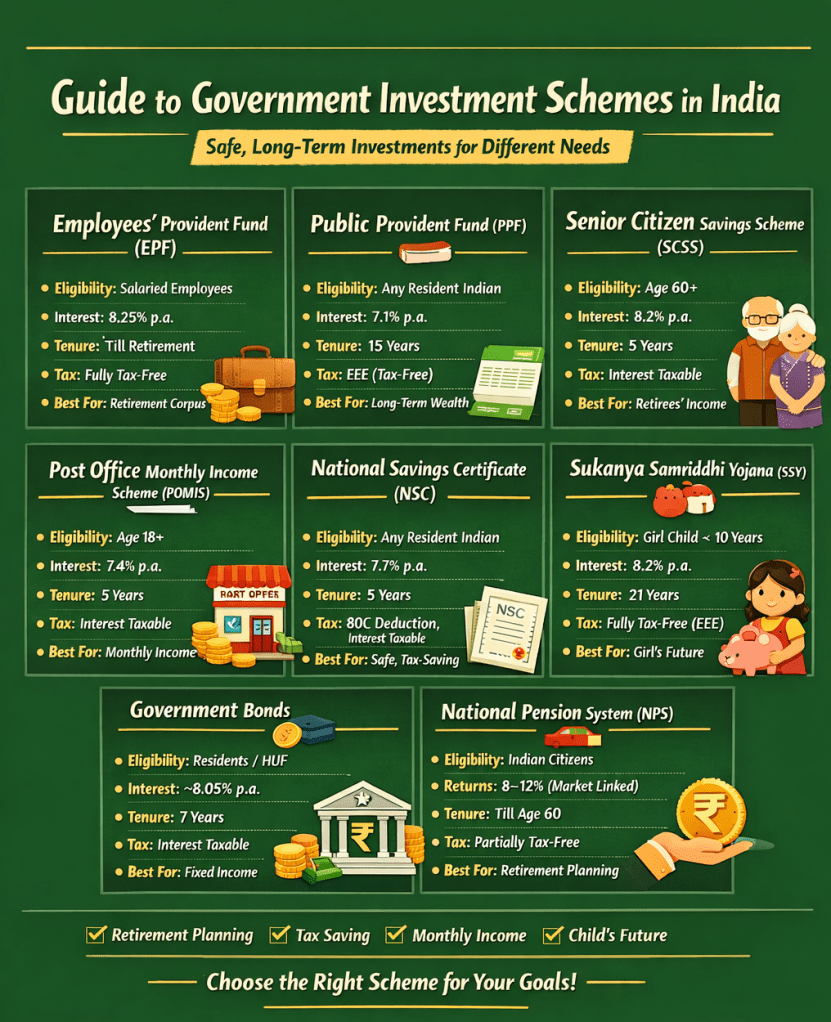

Below is an overview of the key government investment schemes in India, who they are best suited for, and how to use them wisely.

Employees’ Provident Fund (EPF)

EPF applies to employees working in organisations with 20 or more employees. While mandatory for those earning up to ₹15,000 per month, higher-income employees can choose to opt in or out at the time of joining.

You contribute 12% of your basic salary plus 12% is contributed by your company. So straightaway 24% of your basic salary is mandatorily invested.

You can withdraw the amount when you retire or are unemployed for more than 2 months. Partial withdrawal up to 75% of your fund is allowed for selected purposes. But overall, it’s difficult to access these funds while you are working.

With an yearly interest rate of 8.25%, EPF offers returns higher than most fixed-income alternatives. The interest is not paid to you but it gets added to your fund balance.

Employer contributions and interest earned are tax-free, making EPF one of the most efficient debt instruments for salaried individuals.

Public Provident Fund (PPF)

For non-salaried individuals or those without EPF, Public Provident Fund serves a similar purpose.

Any Indian resident can invest between ₹500 and ₹1.5 lakh per year. PPF has a 15-year lock-in, with partial withdrawals allowed after 7 years. At maturity, the account can be extended in blocks of five years.

The current interest rate is 7.1%, fully tax-exempt. Unlike EPF, contributions are not automatic, so the key challenge with PPF is maintaining deposit discipline.

It is a good long-term debt option for self-employed individuals, freelancers, and business owners.

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme is for residents aged 60 and above who need regular income.

SCSS offers 8.2% interest, paid quarterly, with an initial lock-in of five years (extendable by three years).

The interest is better than fixed deposit but the interest is taxable as per your income slab rate.

Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme offers monthly interest income at 7.4% rate, with a five-year maturity.

Premature withdrawal is allowed after one year with penalties and the interest is fully taxable.

It is useful for conservative investors seeking monthly income, but tax-adjusted returns are modest.

National Savings Certificate (NSC)

The National Savings Certificate offers yearly interest rate of 7.7% but they have a lock-in of 5 years.

Interest is not paid periodically but is compounded and paid at the maturity. And the interest is taxable.

There is no regular income, no liquidity before maturity, or tax benefit. So, they have limited appeal today. For most investors, EPF, PPF, or even high-quality debt mutual funds are superior choices.

Sukanya Samriddhi Yojana (SSY)

The Sukanya Samriddhi Yojana is a targeted scheme for parents of a girl child below 10 years of age.

Investments continue for 15 years, and the investment matures when the girl turns 21 years in age.

The current interest rate is 8.2%, fully tax-exempt. Partial withdrawal of up to 50% is allowed after the child turns 18.

It is one of the better low-risk instruments for funding a daughter’s education.

How to Think About Government Schemes

Government schemes’ purpose in your portfolio is to protect capital, enforce disciplined of long-term savings and in some cases provide periodic income. They form a stable base of a portfolio, but they are not designed to maximise returns.

For wealth building, when you have more than 5 years investment horizon, especially for younger investors, equities are a superior growth option.

Leave a comment