Six Things You Must Know Before Putting in Your Money in to any Investment Product

Safety.

Confirm credibility of the people you are dealing with & the product they are offering. Internet is filled with crooks who are trying their best to steal your money.

Don’t get charmed by fancy promises, understand the product, underlying assets, how your money will be used and how the investment will make money. If something sounds too good to be true, trust your gut and walk away.

Even with well established, authentic products, understand the potential risks and assess if there is any possibility of losing your investment in an adverse scenario.

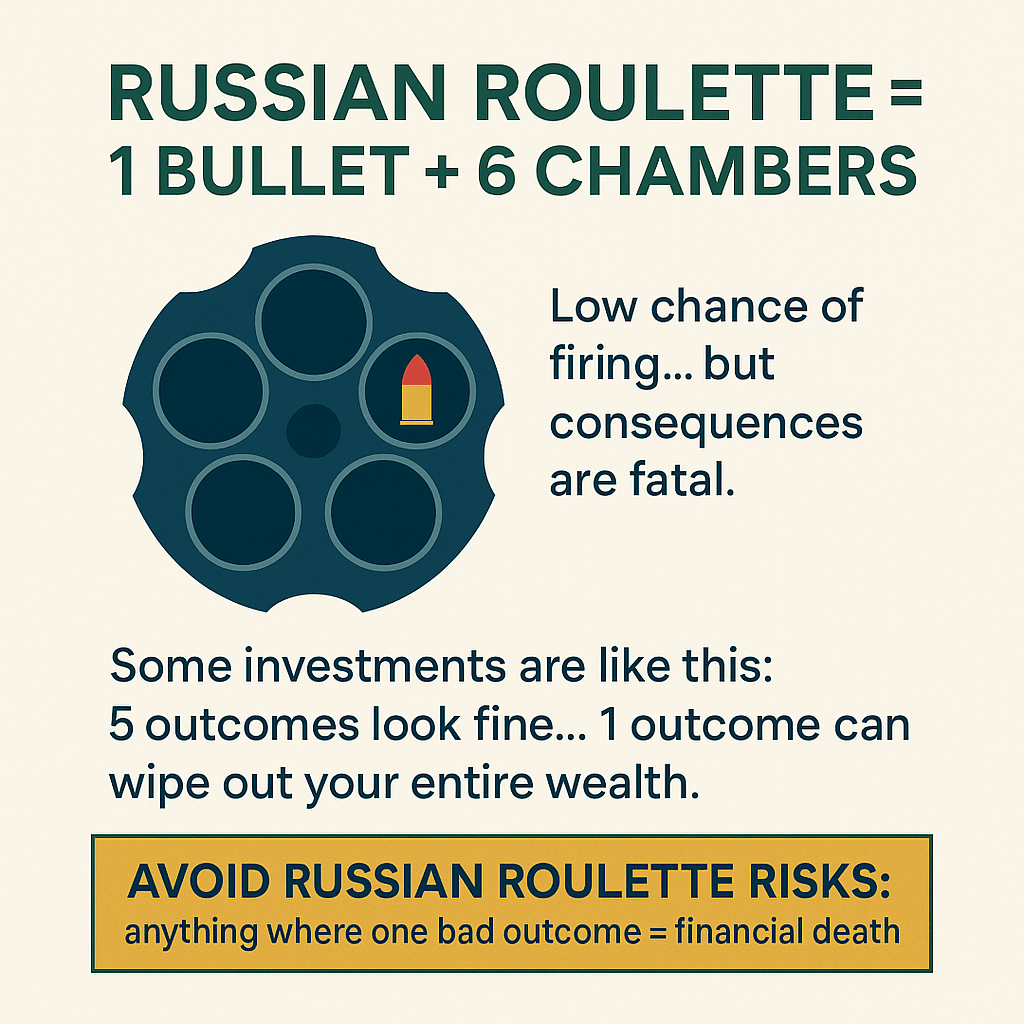

Safety of your invested capital is most important. Avoid Russian Roulette type gambles where the gains may be very attractive, but in one shot you may lose everything.

Afterall, staying in the game for the long-term matters far more than occasional higher returns by chance.

Potential Returns.

Before investing you must have an idea of potential rate of returns and source of return. Your returns could come from periodic interest/dividend payments or growth in market value of the investment over time.

For the growth in market value, do not let anyone fool you by promising high growth like 5 or 10 times after 20-30 years. Always ask what would be the yearly return. What is the CAGR – Compounded Annual Growth Rate. An asset growing 4 times in 25 years, means just 5.7% annual gain.

For any investment to be economically profitable, it should grow at more than the inflation rate of ~6%. Anything earning less is losing your purchasing power.

You should also compare the potential return against available safe alternatives. E.g. if a normal bank FD is offering you 6-7% return, that should be the minimum benchmark for investing anywhere else.

Liquidity & Lock-in Periods.

Liquidity means how quickly & easily you can sell the investment and get your money in to your bank account.

You must knowif the investment has any lock-in period. Can you withdraw the investment before maturity. Are there any charges (Exit Load) for premature withdrawals.

Many government schemes do not allow withdrawal before maturity. Mutual funds can be sold at your will but some funds charge 1-2% exit load if sold within 3 years. Some insurance linked products require minimum instalment payments and have heavy penalties for early surrender.

If you do not understand the lock-ins, you may not be able to access your money when you need it.

Price Volatility.

You should also be aware of price volatility, that is likely rise and fall in the market value of your investment. Prices fluctuate. Assess whether you can tolerate such price fluctuations without panicking.

Transaction Costs.

Understand all costs involved in buying, maintaining and selling any investment. Even small charges compound over time and eat-up sizable part of your gains.

Income Taxes.

Income taxes are inevitable. Understand the applicable taxes, the rate of tax as well as timing of tax payment. Generally, income like interest and dividends are taxed yearly at your income tax slab rate and growth in the market value of investment is treated as capital gain and taxed when you sell the asset. The post tax returns, is what you get in hand and ultimately that’s your true return.

Know your investment and then invest.

Leave a comment