When I was in school, I had a daily allowance of ₹ 5. The bus fare to my school was ₹ 2 so after keeping aside ₹ 4 for my commute, I had ₹ 1 to buy a guava or tamarind from an old lady outside my school. That extra ₹ 1 in my hand made me feel so rich.

That was in early 2000s, a different time when I didn’t have to worry about calories or food hygiene and ₹ 1 could buy happiness.

Fast forward 25 years, and so much has changed. Eating whole strip of tamarind is out of question and that precious ₹ 1 barely buys anything anymore.

Have you noticed that the ₹ 500 note feels smaller than it did a few years ago? Not just in size, but in what it can buy.

Back in the early 2000s, sugar used to cost ₹ 10 per kg, today, it’s over ₹40. A 100-gram pack of Maggi used to be ₹ 5, and now it’s around ₹ 20. Annual school fees that were around ₹ 30,000 have now jumped over ₹2 lakh.

Daily essentials like food and groceries cost about 4 times more compared to 25 years back, while education and healthcare costs have jumped nearly 7–8 times.

The culprit is Inflation.

Inflation is the rate at which the prices of goods and services rise over time.

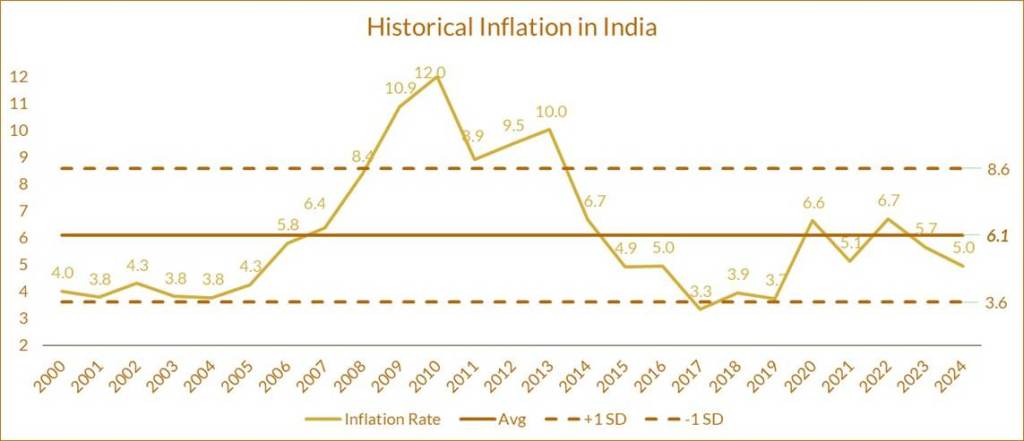

On average, annual inflation in India has been around 6%.

Purchasing Power of Money

Because of inflation, the purchasing power of your money, that is the quantity you can buy with that money keeps on shrinking. In simple words, as prices go up, the value of money goes down. For instance, with ₹ 100, you could buy 10 kg of sugar 25 years back. Today, that ₹ 100 will get you just 2 kg.

At 6% inflation, if something costs ₹ 100 today, it is likely to cost around ₹ 133 five years from now and the value of your ₹ 100 would reduce to ₹ 74.

Inflation affects every aspect of your financial life.

Earnings:

You got a 5% hike in salary? Don’t rush to celebrate. At 6% inflation, you will be actually earning less in real terms. Your increased salary won’t buy you as much as before. Your real earnings grow only when your salary increases at the rate higher than inflation rate.

Savings:

Money kept under the mattress, in a locker, or even in a savings account, may feel safe but it isn’t. Your idle cash is losing 6% of its value every year. If your bank gives 3% interest when inflation is 6%, your money is losing 3%. This is why it’s important to make your money work by investing it.

Investments:

But the true test of any investment performance is ‘Real Return’. Real Returns are the difference between the Nominal Returns (the returns you see on paper) less inflation in that period.

For instance, if land prices triple in 20 years but the cost of living has gone up 3.2 times, the investment hasn’t created wealth. A good investment is one that grows faster than the rate of inflation.

Planning for the Future:

While planning for funding your wedding, child’s education, your retirement or deciding health insurance coverage it is important to account for rising prices.

For instance, if your household expenses are ₹ 50,000 now, they might be ₹ 90,000 in 10 years, and by the time you retire in 25 years, they could soar to more than ₹ 2 lakhs a month!

Costs for things like healthcare or travel often rise even faster than general inflation. That big foreign trip you are planning to take after 5 years, may cost ₹ 1 lakh today but could be ₹ 1.5 lakh when you actually take it.

What Can You Do About It?

Inflation is invisible but very powerful. It quietly eats into your savings and wealth. To keep up with rising prices, your earnings and investments need to grow at least as fast as inflation. Otherwise, you may have to compromise your standard of living over time.

- Plan for the long-term – Always calculate future costs with inflation in mind.

- Don’t let money sleep – Cash loses value if it doesn’t grow.

- Always check real returns – A 6% Fixed Deposit may sound great, but if inflation is 6%, there is no increase in your wealth.

- Invest in assets that beat inflation – Equities, equity mutual funds, real estate, and other growth-oriented investments.

Remember, the only way to protect yourself is to make sure your income and investments grow faster than inflation.

Leave a comment